Tariffs in Fall 2025, Explained Visually

There’s so much law here and it’s complex and confusing! Tariffs feel faraway and obtuse, but with so many of our products and goods coming from abroad, and such a widespread attempt to impose tariffs on so many things, they’re going to impact our regular purchases eventually, if they haven’t already.

Let’s look at who gets to impose tariffs, the different kinds at play, and what is up with tariffs and the Supreme Court.

Who gets to impose tariffs?

For the government to do basically anything (legally), something in our laws has to allow that part of government to do that thing.

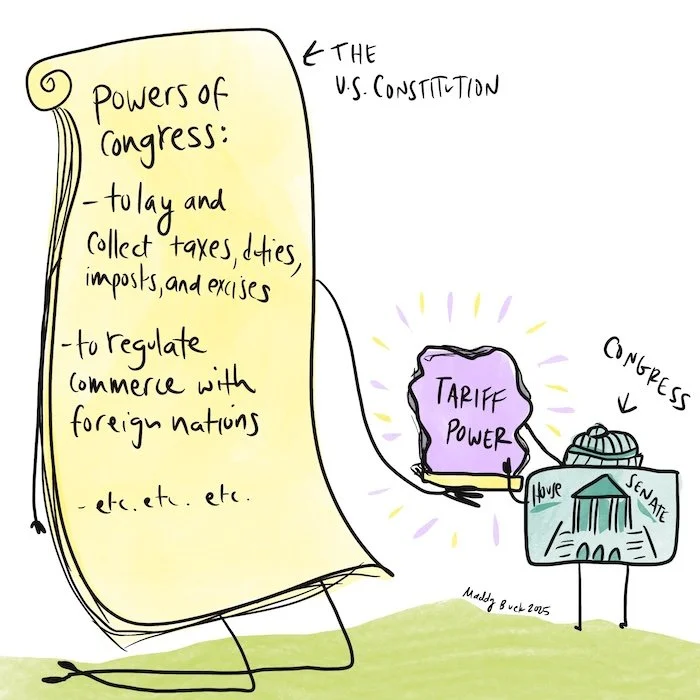

It starts with Congress

The U.S. Constitution says that Congress has the power to “lay and collect Taxes, Duties, Imposts and Excises” and to “regulate Commerce with foreign Nations.”

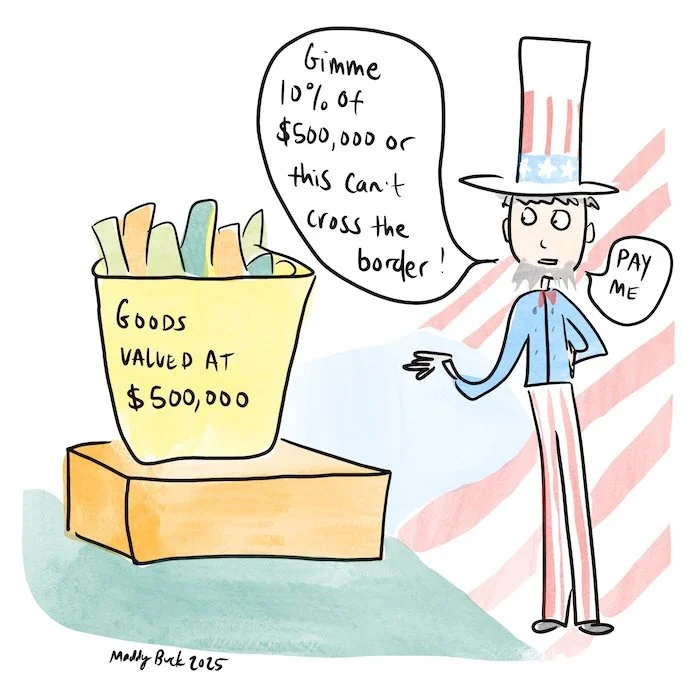

(Tariffs are a tax on things coming into the country.)

Congress has delegated some tariff powers to the Executive Branch

Congress has passed laws over the years to give some tariff powers to the president and the executive branch, in limited ways.

Giving bits of power away like this is common and is why we have “executive agencies.” For complex things that need to be in flux, Congress doesn’t want to be making all the tiny decisions, so it writes the law in a way that gives certain powers to the executive branch, usually a specific agency.

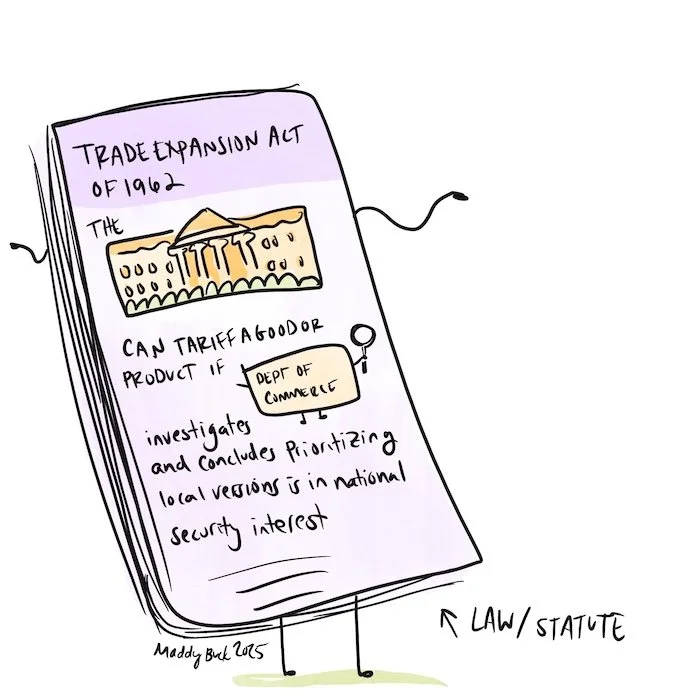

For example, the Trade Expansion Act of 1962 (a law passed by Congress) allows the president to adjust tariffs on specific goods and products, no matter where they’re from, if the Department of Commerce (an executive agency) investigates and concludes that tariffs would be in the interest of national security. This process includes an opportunity for businesses in the relevant sector to comment.

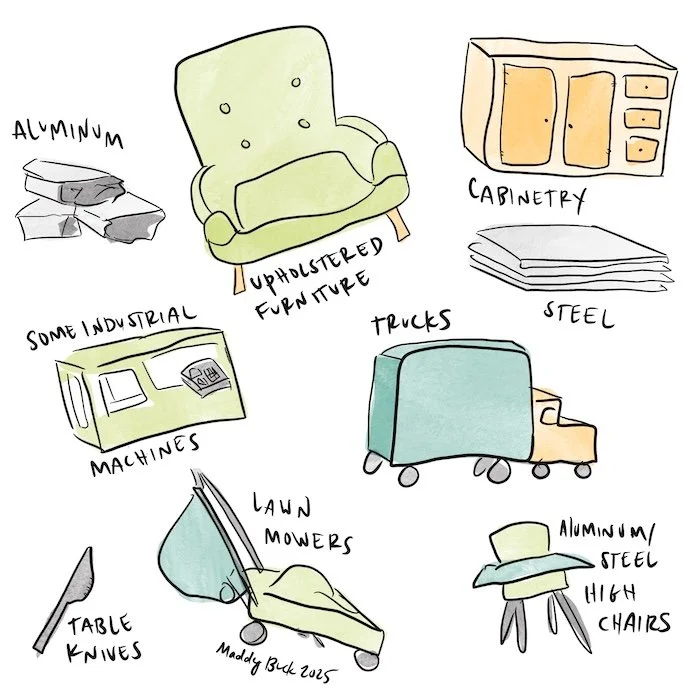

These are known as the “Section 232 tariffs,” which the Administration has imposed on:

and more. The list is likely to expand.

These tariffs are raising costs (sometimes over night, as they’re often imposed immediately with little warning, with no exceptions for goods in transit) on any company importing or distributing these products into the U.S. Imagine you have a ship full of these specific products, already invoiced, on their way to the U.S. While they’re on the ship, the cost is raised by 10, 20, or 25%. Yikes.

Even though it’s a matter of opinion whether relying on a foreign supply chain for all of these goods is a national security issue (table knives made out of steel??), tariffs imposed under this law are so far more in line with the limited scope of tariff power Congress gave to the Executive Branch.

Businesses that deal with these products and materials are probably not happy about these tariffs, especially if they had goods in transit when the tariffs were announced. These are significant additional costs that will likely hit consumers eventually. But they’re not the tariffs everyone’s talking about.

What about the Trump tariffs? Aren’t they at the Supreme Court?!

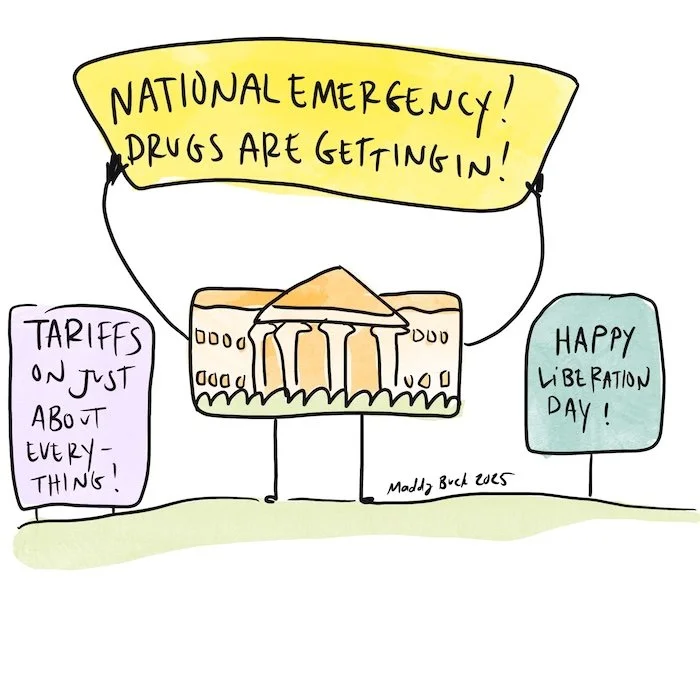

The tariffs that are most in the news are different. I’m talking about the “Liberation Day” tariffs, the “reciprocal tariffs,” the ones every country has to make a deal on. In these, the Trump Administration claims that International Emergency Economic Powers Act (IEEPA) gives it the power to impose whatever tariffs it wants, as long as it makes an argument that there’s a “national emergency.”

So, the Administration declared the influx of illegal drugs as a national emergency.

Then it started setting various tariffs on everything coming in from abroad, leading to deals with specific countries to adjust the tariff rates.

Remember how the Constitution gave Congress the tax and tariff power? Well, this would be a HUGE reach into Congress’s domain, if IEEPA’s emergency powers are interpreted to allow basically any tariff at all.

So are these IEEPA tariffs allowed? Did Congress intend to give this kind of tariff power to the president?

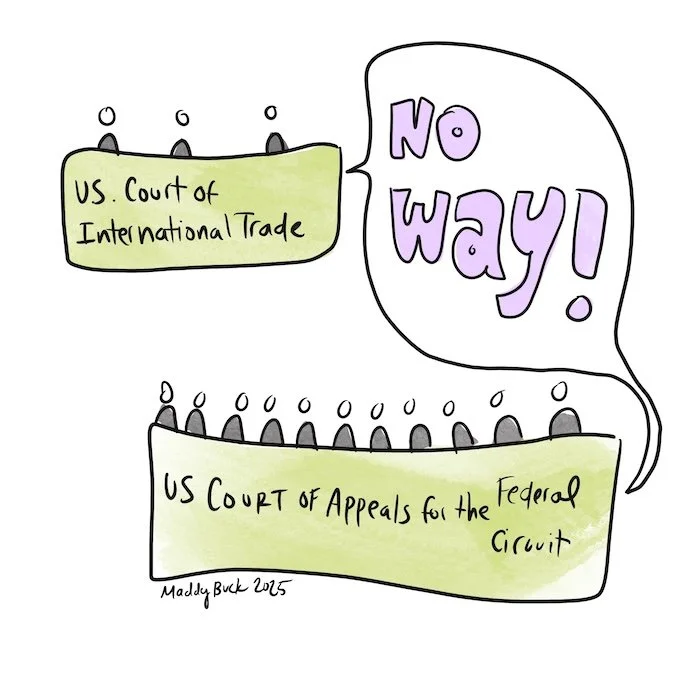

Up until now, the courts that have looked at this have said, “no way!”

Why not? The Court of Appeals for the Federal Circuit didn’t weigh in on the claimed drug trafficking emergency and whether or not it’s valid. Instead, they looked at what the law says. Other laws do give some limited tariff powers to the executive branch, as we saw above. But they use very different, very clear, very tariff-y language.

IEEPA doesn’t use this language, so they conclude it doesn’t give the president any tariff powers.5

What will happen at the Supreme Court?

The Supreme Court is hearing oral argument for this case on November 5.

This Supreme Court has been very conciliatory to the current administration and could always interpret the law in a way that makes it seems like these “emergency” tariffs were what Congress intended all along. That would be a pretty devastating decision for the concept of separation of powers.

Or the Administration could lose, and these all-encompassing “emergency” tariffs would have to go away. There’s already talk of how companies would get refunds for the tariffs they’ve already paid.

If the IEEPA tariffs go away, will that be the end of all the tariffs?

No. The Administration continues to add products and goods to the list of things being tariffed based on national security concerns; those “Section 232 tariffs.” And there are a few other laws that more clearly allow tariffs in limited situations or for limited time periods, which would still be available for the president to use.

It seems likely that the costs of these tariffs on certain raw materials, machinery, and some very specific products will be passed on to consumers eventually.